Risk Management

The Company conducts management based on the enterprise risk management (ERM) framework established with the aim of continuously enhancing enterprise value through the integrated management of risks associated with strategic objectives.

Risk Management Policy

Positioning risk management as a critically important task for management, the Company has put in place the policy and rules concerning risk management established by the board of directors. Based on such policy and rules, we select, clarify, and assess risks and control them in an appropriate manner with the objective of enhancing profitability while maintaining financial soundness. Prompted by the recognition that risk management is a key to enhancing enterprise value, we are continually implementing measures to upgrade our risk management.

Risk Management Structure and Procedures

1.Risk Management Structure

In accordance with the risk management policy established by the board of directors, the board of directors has also established rules on ERM, which is a process involving the continuous enhancement of enterprise value, and management rules for individual risks. Moreover, the board of directors deliberates and makes decisions on material matters concerning risk management and receives reports from risk management departments periodically and, additionally, whenever necessary on the situation regarding risk. Thus, systems and structures are put in place that enable the Company’s board of directors to precisely grasp enterprise risks and individual risks.

Furthermore, the Company has the ERM Committee for the purpose of risk management from a perspective crosscutting organizations and risk categories, and systems are in place to ensure that matters concerning material risk management are reviewed by the ERM Committee and then submitted to the board of directors.

The Internal Audit Department, from an independent standpoint, assesses and validates the effectiveness of the risk management structure described above.

■Risk Management Structure

2.Integrated Risk Management

Integrated risk management function spearheads integrated and comprehensive risk management (including comprehensive management of assets and liabilities). The Integrated risk management function measures the integrated risk amount of reinsurance underwriting risk, investment risk, etc., using a stochastic approach and assesses and checks capital adequacy and risk-returns, also taking into consideration the medium- to long-term perspective. Moreover, based on scenarios, such as the occurrence of a major earthquake or a great decline in the stock market, that would have significant impacts on operations of a reinsurance company, the Integrated risk management function assesses and analyzes by means of stress tests the extent and the degree of impact of such risks that exceed any normal projection and utilizes the results of the tests for verification of capital adequacy and business continuity.

In addition, with regard to qualitative management, in order to grasp the risk profile of the entire Group, the Company periodically performs exhaustive risk identification, including emerging risks, classifies the risks according to the frequency and the severity, and assesses their materiality.

3.Individual Risk Management

Risks that should be managed individually are classified into reinsurance underwriting risk, investment risk, operational risk, overseas operational risk, and reserve risk concerning underwriting reserve and reserve for outstanding claims. Each of these risks is handled by an individual risk management department in order to respond to them appropriately. Individual risk management departments collaborate with the departments concerned, including business departments, and implement management according to the characteristics of each risk through the basic processes of risk identification, assessment, monitoring, and control.

ERM-based Business Operation (Risk Appetite Framework)

The Company has put in place a risk appetite framework as part of ERM to improve profitability while maintaining financial soundness through appropriate management of the Group’s capital, returns, and risks.

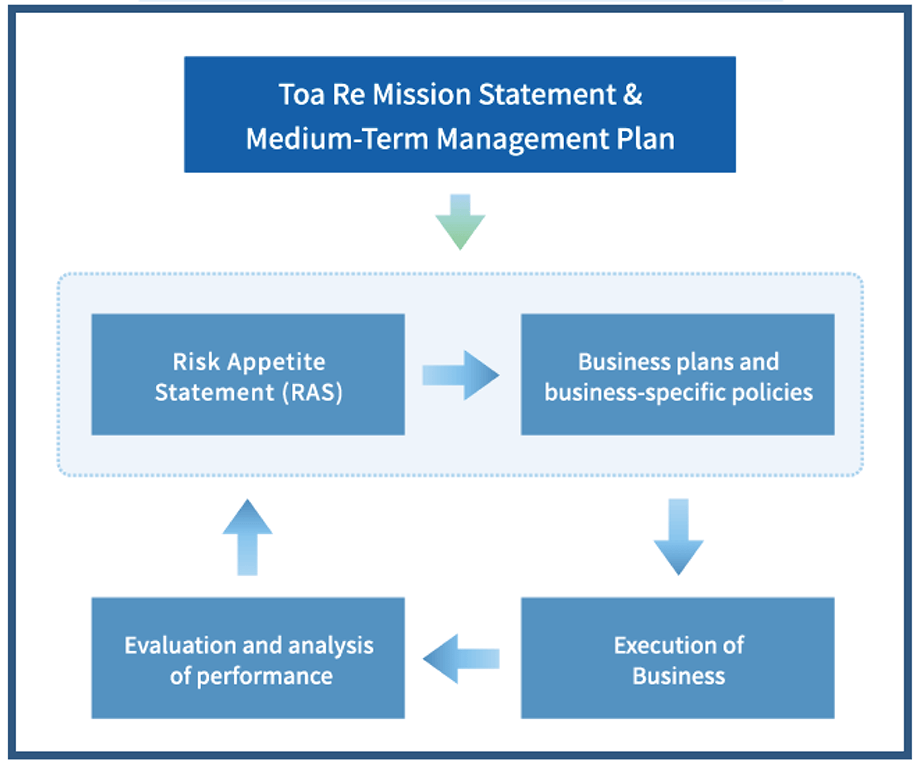

■Risk Appetite Framework

In the risk appetite framework, the policies on risk-taking of the entire Group and of each business are articulated as the risk appetite statement, and based on these policies the business plan (including the risk-return plan based on capital allocation) of the entire Group and of each site and each business is formulated. Business is executed based on the plan, and business results, the outcome of the business execution, are assessed and analyzed periodically (including risk-return assessment and analysis based on capital allocation). The results of the assessment and analysis of business results are reflected in subsequent formulation of policies and plans. By repeating this cycle, the Company aims to continuously enhance profitability while maintaining strong financial soundness.