Compliance

In the non-life insurance industry, which is an important element of public infrastructure, companies are required to comply with laws and regulations and demonstrate high ethical standards in every aspect of their professional conduct. The business of Toa Re, the only full-line comprehensive reinsurance company headquartered in Japan, is based on globally accepted, free and fair business practices, and moreover, on strict compliance with the laws and regulations and the high ethical standards that constitute the essential foundation for those practices. Our company has never received any administrative order.

1.Basic Compliance Policy

With the aim of putting into practice our Mission Statement of “Providing Peace of Mind, ” Toa Re has set forth “Basic Compliance Policy” so that all personnel implement compliance and promoted compliance activities.

2.Compliance Structure

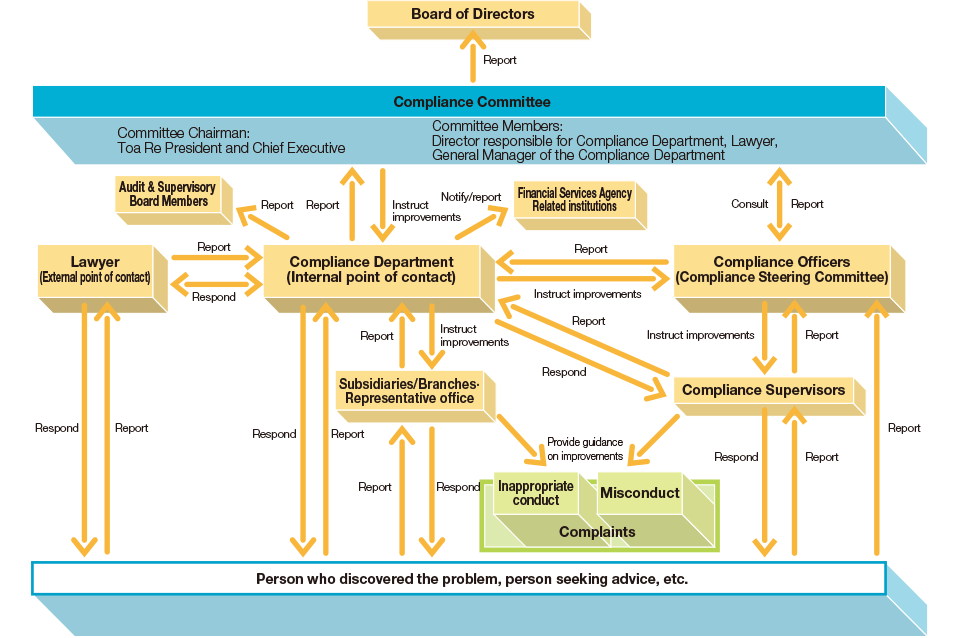

- Compliance Structure

The Company has established the Compliance Committee, which is chaired by the president and whose members include an external lawyer. In addition, the Company has established the Compliance Steering Committee comprising department managers who are appointed as compliance officers. Each department assigns a person to serve as a compliance supervisor, in order to promote compliance activities as a whole organization. Also, putting in place similar systems at overseas branches and subsidiaries, the Company is striving to strengthen compliance throughout the Group.

- Compliance Program

Each fiscal year, the Board of Directors establishes the Compliance Program, a concrete compliance implementation plan, and on the basis of the program the Company conducts education and training and engages in other compliance activities.

- Whistle-blower system

The Company has established internal and external points of contact for employees etc. to report or seek consultation and advice about any unlawful conduct in the Toa Re Group. The Company has put in place a system for reporting to the Compliance Committee, the Board of Directors, and Audit & Supervisory Board Members to enable swift implementation of corrective measures. The Company has also put in place a system to ensure reporting to the supervisory agency if a matter reported is deemed unlawful.

Compliance Reporting Structure

Basic Compliance Policy

The Toa Reinsurance Group positions compliance at the core of all business activities, and we have set forth this policy so that all personnel remain aware of the Toa Reinsurance Group’s social responsibility and implement compliance on a daily basis.

1. Purpose of activities

With the aim of putting into practice our Mission Statement of “Providing Peace of Mind,” comply with laws and regulations and carry on fair and honest business activities in accordance with societal norms and corporate ethics.

2. Compliance promotion structure

- Establish a compliance function (hereinafter “Compliance Department”) within the head office that will promote compliance activities and provide centralized management of compliance-related matters.

- Formulate compliance-related policies and rules and, via the Compliance Department, promote full knowledge and observance of those policies and rules among all the personnel of the group.

- Carry out regular training and monitoring to fully develop a compliance-oriented corporate culture.

- Put in place a reporting and consultation system for compliance-related problems and endeavor to ensure early detection and correction.

3. Code of Conduct

For the practical implementation of this policy as a group, the following Code of Conduct has been defined.

- Conformity to laws, regulations, and ethical standards

For the execution of fair and honest corporate activities, conform to all laws and regulations and act in accordance with ethical standards. - Free and fair competition

Always be aware of the great importance of the social responsibility of the reinsurance industry, and carry out sound management based on fairness, transparency, and free competition. - Prohibition of conflicts of interest

So as not to unfairly damage customer interests, manage transactions where there is a danger of a conflict of interest. - Prohibition of insider trading

Do not trade a company’s stock etc. using information that has not been made public, and do not advise such trading by communicating such information to another person. - Protection of intellectual property

Respect the intellectual property possessed by others and take care not to infringe upon it. - Handling of antisocial forces

Take a firm approach to antisocial forces that are a threat to the order and safety of society. - Anti-Money Laundering / Countering the Financing of Terrorism

Endeavor to ensure that our group products and services are not used to transfer the proceeds of crime, to supply funds to terrorists, or to provide funds for the dissemination of weapons of mass destruction. - Prohibition of bribery

Do not provide or accept gifts, entertainment, or other benefits that are inappropriate or that exceed the scope of socially accepted practices. - Communication with society and disclosure of company information

Maintain wide-ranging communication with shareholders as well as other members of society, actively and fairly disclose company information, and strive to properly manage information. - Social contributions activities

Actively engage in social contribution activities as a good corporate citizen. - Respect for human rights

Respect basic human rights and refuse to accept any discrimination based on race, nationality, gender, age, physical differences, etc. - Protection of the global environment

Recognizing that measures for the protection of the global environment are indispensable for the existence and functioning of a company, actively and voluntarily take action aimed at the realization of a sustainable society. - Conscientious action

To ensure that our group corporate value and our stakeholders' interests are not damaged or infringed upon, act in a conscientious manner based on a strong sense of ethics and with decency as a member of society. - Protection of company assets

Use company assets only for business activities and ensure that they are not damaged. - Information management

Personal information and other confidential information that is acquired in conjunction with work is to be handled appropriately based on laws, regulations, etc. - Reporting and consultations

If you notice an unethical act or an act which violates a law, regulation, etc.; report to and consult with your supervisor or the Whistleblowing system without delay. The company will not allow such reporting and consultation to result in disadvantageous treatment or retaliatory acts with respect to personnel who engaged in the reporting and consultation or personnel who cooperated with the subsequent investigation. - Pursuit of best practices

Going beyond the guidelines stated here, pursue best practices at every opportunity.